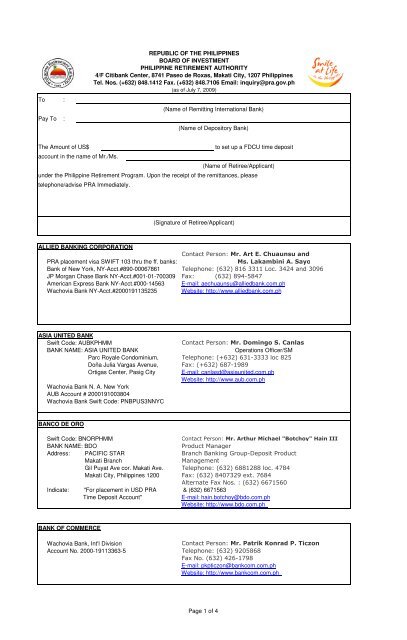

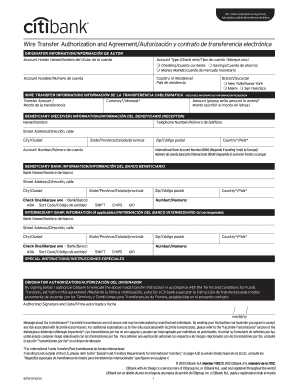

- Citibank Wire Transfer Authorization Form

- Citibank Wire Transfer Form

- Citibank Wire Transfer Application Form

The tips below will help you fill in Citibank Wire Transfer Form easily and quickly: Open the form in the full-fledged online editor by clicking Get form. Fill in the required fields that are colored in yellow. Hit the green arrow with the inscription Next to jump from box to box. The tips below will help you fill in Citibank Wire Transfer Form easily and quickly: Open the form in the full-fledged online editor by clicking Get form. Fill in the required fields that are colored in yellow. Hit the green arrow with the inscription Next to jump from box to box. Instant funds transfer to 18 countries and regions with the handling fees waived 1; Applicable to worldwide Citibank ® account under self-name or designated third party's name; Outward remittance is applicable through Savings, Checking and Currency Manager Accounts for all currencies except RMB, while inward remittance is applicable through Savings and Checking.

Citibank account holders can send money directly to bank accounts around the world using wire transfers, or Citibank’s other specialist services.

The account type you hold, as well as the specific detail of the transfer you need to make, will dictate the fee you pay. This guide runs through all you need to know, and also introduces Wise as a smart alternative when sending payments overseas.

Citibank Wire transfer fee

You can send money domestically and internationally with Citibank. There are different ways to set up your payment depending on where you’re sending to, including which bank holds the account you want to transfer into.

Here are the fees you need to know about:

Citibank local transfer fee

You’ll have different options - and different fees - depending on the specific transfer you need to make.

If you’re sending money to a US based account in your own name, even with a different bank, you should be able to use the Citibank Inter-institution Transfer service for free.

If you’re sending money to someone else who also has a US based Citibank account, you can choose the Citibank Global Transfer option, which is also fee free.

However, if you’re sending money to someone else in the US, and they don’t have a Citibank account, you’ll need to use the wire transfer service. This may mean you pay a fee, depending on the account type you hold.

Generally, accounts offered under the Citigold Private brand, Citi Private Bank accounts and Citi Global Executive accounts have fee waivers for local transfers. Other account types will pay a fee, which ranges from USD10 - USD25.

Citibank international wire transfer fee

Citibank clients can send money to other Citibank accounts around the world for no upfront fee. However, there is a charge wrapped up in the exchange rate used, which can push up costs. We’ll cover that in a moment.

If you’re sending a wire to someone without a Citibank account you may need to pay a fee, and may also have costs added to the exchange rate offered if you’re converting currency as part of the payment. As with local transfers, accounts offered under the Citigold Private brand, Citi Private Bank accounts and Citi Global Executive accounts don’t charge upfront fees for international transfers. Other account types have fees which range from USD10 - USD35 per transfer.

Citibank currency exchange rate

If you need to send money through Citibank to an account held in a different currency, you’ll pay an additional fee as part of the exchange rate offered. Here’s what Citibank says in their transfer terms and conditions:

“If the transfer is made in foreign currency, the exchange rate includes a fee for the currency conversion.”

What this means is that Citibank will add a markup or margin to the exchange rate they use to convert your USD to the currency you need to deposit. This is not unusual, but can mean you pay more than you’re expecting for your international transfer or wire. To avoid exchange rate fees, choose a provider which uses the mid-market exchange rate - the same rate you’ll find on Google. This makes it easier to see the true cost of your transfer, and can cut the price you pay overall.

Wise: the alternative that uses the mid-market rate

Your bank isn’t the only option when it comes to sending an international transfer. Using a third party can be just as simple - and often cheaper and faster too.

Try Wise for low-cost international payments which use the mid-market exchange rate with no markup. You only ever pay a simple, transparent fee for your transaction, and can see exactly what your recipient will get before you confirm the payment.

Check out Wise for more information and a helpful comparison table showing how Wise international payments stack up against other major providers.

How to make an international wire transfer with Citibank?

The simplest way to make a Citibank international wire is to set the payment up online. Simply log into your online banking and follow the prompts to enter the required information. Review the costs including the exchange rate markup which is applied, and confirm the payment to get started.

How long does a wire transfer with Citibank take?

Wire payments are processed on the day they’re received, as long as they’re submitted by 5.15pm ET on a normal banking day. After that time, or on non-working days, payments will be processed on the following banking day.

The length of time it takes for your payment to be received depends on the destination country and the processes in place at your recipient’s bank. You can expect a wait of 1 - 3 days, or more if there are local holidays or processing delays.

Citibank Wire transfer information

To set up a Citibank international wire you’ll need to know:

- The recipient’s name as shown on their bank account

- Name and address of the recipient’s bank

- Recipient’s account number

- Recipient bank’s BIC/SWIFT code

Depending on the destination country you might also have to provide some additional details like an IBAN or sort code, and confirm the reason for the transfer.

How to receive a wire transfer

Citibank Wire Transfer Authorization Form

To receive a wire transfer, you’ll need to make sure the sender has all the information they need to get the money to your account safely. This will include your name, bank account number, branch address, and other details such as a routing number for domestic payments, or SWIFT code if the money is coming from overseas.

Check the details are all complete and correct because wire transfers which are sent using the wrong information can end up being delayed or returned to the sender.

Citibank incoming wire fee

Some account types come with a fee waiver for incoming transfers. If your account does not have a waiver, you’ll pay USD15 per incoming wire.

Citibank offers customers a few different ways to send money to other accounts, including free transfers to accounts in your own name within the US, and to other Citibank accounts globally. However, the account type you hold will make a big difference if you’re sending a Citibank wire, with fees waived or reduced for some accounts.

Don’t forget that even if you qualify for a fee-free international transfer, you’ll still pay a fee which is included in the exchange rate applied to your transfer. Avoid this by choosing a third party provider like Wise to set up the payment instead. You’ll benefit from the real exchange rate with no markup, and only a low transparent fee which could mean you save.

Citibank Wire Transfer Form

All services provided under Global Banking Services are subject to availability and local regulatory restrictions and Citibank (Hong Kong) Limited does not guarantee the availability of any of these services in any markets Citibank operates. Citibank reserves the right to change Global Banking Services product offerings without prior notice to clients. Global Banking Services are applicable to designated regions only. Some regions are exempted from providing part of the services and some services are only applicable to Citigold clients. Please refer to the Terms & Conditions of Global Banking Services stated below.

Citibank Wire Transfer Application Form

Citibank Global Transfer

Applicable to handling fees incurred by Citibank (HK) Ltd only. For incoming fund transfers from overseas Citibank branches, please refer to each originating country's fees and charges.

This service is only applicable to clients of Citibank (Hong Kong) Limited. Transaction screening may apply, this may lead to the delay of the transaction.

If the transaction involves currency conversion, such currency conversion will be converted at the prevailing exchange rate for this service as determined by the Bank on the conversion day.